The Stablecoin Economy’s Identity Crisis

This article was made possible with the support of @idOS_network

Executive Summary

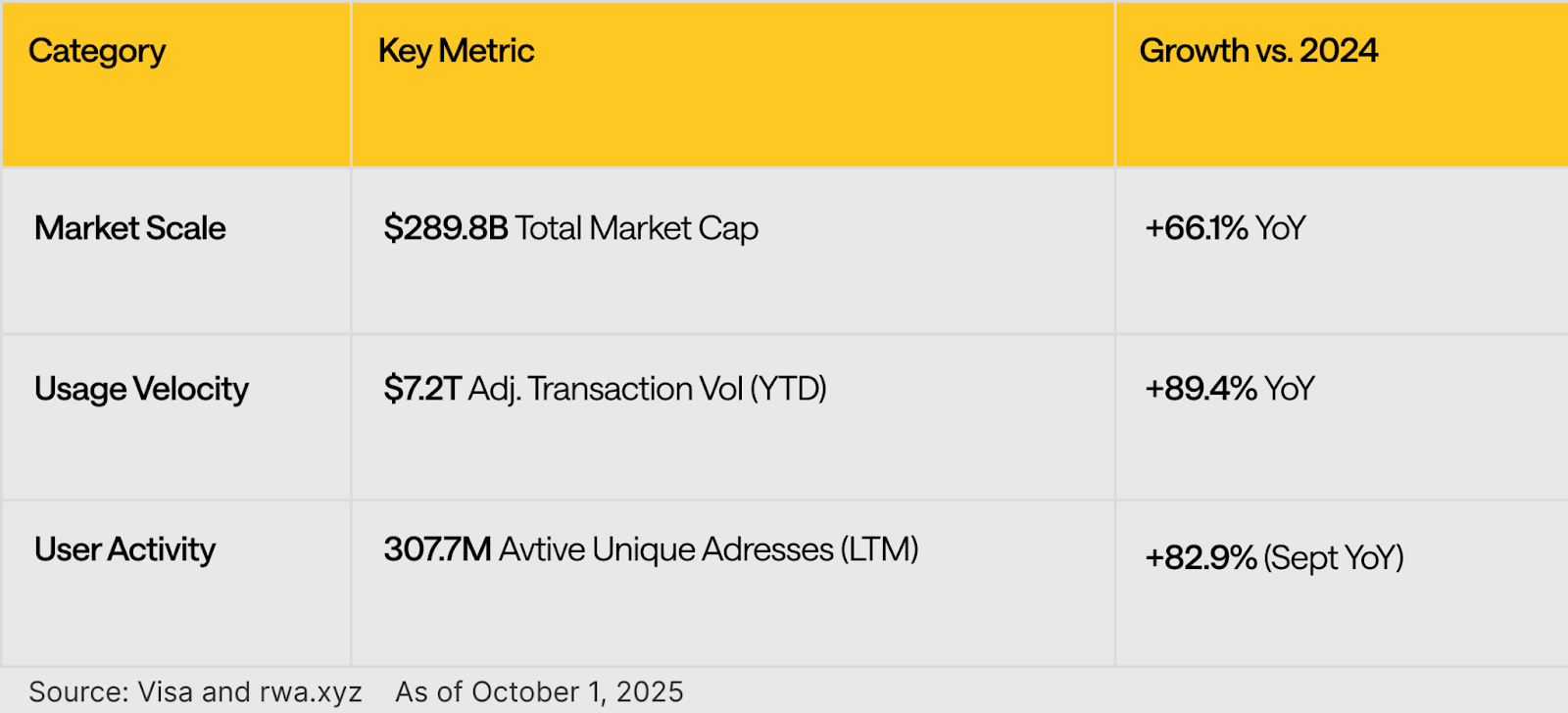

The stablecoin economy has transitioned from a crypto niche into a $290 billion financial powerhouse, and is currently experiencing an explosive growth, characterized by an 89.4% YoY surge in volume. This rapid expansion, underpinned by formalizing legislation such as GENIUS and MiCA, has established digital assets as bank-grade financial tools. However, the industry is being slowed down by a last-mile problem: a fragmented and outdated identity verification architecture that imposes a systeming “Identity Tax” on every market participant.

This report analyzes the results of an exploratory survey of leading founders and C-level executives from firms including Aave Labs, RedStone, Holyheld, Midas, and others. Our findings reveal that the industry is experiencing roadblocks building a new financial system on the outdated compliance foundation, leading to:

- The User Onboarding Gauntlet: Redundant KYC processes are driving a catastrophic 70% client loss rate across financial institutions — the highest ever recorded. Current mobile onboarding typically requires 14 screens and 16 distinct fields, creating a high-friction barrier that bleeds customers and stifles mainstream adoption.

- The Compliance Burden: Identity verification is no longer just a regulatory hurdle but a primary operational expense. Half of the surveyed stablecoin-native firms allocate 5-20% of their total annual operational budget to compliance.

- A Massive Opportunity: The market is moving toward a modular identity paradigm. While the core identity verification market is valued at approximately $17 billion, the broader digital identity services revenue reached $51.5 billion in 2025. Furthermore, the ongoing rise of Agentic Commerce — AI agents transacting autonomously — is projected to orchestrate up to $5 trillion in revenue by 2030, creating an urgent need for “Know Your Agent” (KYA) solutions.

The path forward requires a shift from the current status of siloed applications to a universal open identity protocol. By abstracting the complexities of biometrics, fraud prevention, and KYC into a neutral, interoperable layer, the industry can replace “honeypots” of sensitive data with user-controlled verifiable credentials. This evolution is the technical prerequisite for unlocking new onchain financial products, such as under-collateralized lending and decentralized credit networks, realizing the true vision of an open Internet of Money.

The $300 Billion Bottleneck

The prevailing narrative in the digital asset market is a stablecoin gold rush, an intense competition to build the next great neobank and stablecoin orchestration layer. This overwhelming focus, however, is missing a critical piece of the infrastructure stack. The foundational opportunity lies not only in picking the winning "miner" from this competitive landscape, but in manufacturing the essential "picks and shovels" required by the entire industry. A universal, open identity protocol represents that critical, often overlooked infrastructure — the layer that enables the onchain economy to connect with the real users.

The long-forecasted Internet of Money is no longer a distant vision; it is a present-day reality. As of 2025, a parallel financial system is operating at scale, with its own assets, networks, and userbases. The sheer scale of this new economy is remarkable. Onchain stablecoin transaction volume has already surged past $7.2 trillion by October 2025, a figure that demonstrates growing re-platforming of global value transfer. Likewise, stablecoin market capitalization has expanded 66.1% YoY, reaching $289.8 billion.

An explosive 89.4% year-over-year growth in transaction volume represents an acceleration that legacy financial systems cannot hope to match. Such a growth rate represents an accelerating adoption curve. While established players like Visa may still boast larger absolute quarterly volumes, the critical metric is the rate of change. A new set of financial rails is being laid in real time, and the world's value is beginning to move across them at an unprecedented pace.

The high growth is not occurring in a regulatory gray area. Instead, it is being actively accelerated and legitimized by clarifying legislation from the world's major economic blocs. Regulatory clarity is derisking digital assets and transforming them from speculative instruments into bank-grade financial tools, setting the stage for their integration into the core of the global financial system. In the United States, the GENIUS Act of 2025 marked a pivotal event. By establishing a clear legal category for "permitted payment stablecoin issuers," the act provided a defined pathway for compliant digital dollars.

Similarly, the European Union's Markets in Crypto-Assets (MiCA) regulation, now in full effect, establishes a harmonized legal framework for crypto-asset service providers. It creates a single market for digital assets across the EU, providing legal certainty for issuers and exchanges alike. Together, these regulatory frameworks in the US and Europe are creating the official, state-sanctioned channels for the mainstream adoption of stablecoins.

Yet, despite this immense onchain velocity and newfound regulatory legitimacy, a fundamental bottleneck throttles the industry's potential: the last-mile problem. The challenge lies in bridging the high-speed, efficient world of the blockchain to the fragmented and full of friction world of global commerce. The utility of the entire onchain economy is constrained by the quality of these bridges.

The stablecoin economy can be compared to a high-speed bullet train, but its effectiveness is diminished if every passenger is forced through a slow, manual, and invasive security checkpoint at every stop. These stations are the neobanks, the on-ramps, and the payment providers — the critical infrastructure that connects the blockchain to a user's bank account and a merchant's point-of-sale system. The success of these gateways is therefore fundamentally tied to the growth of the entire stablecoin ecosystem. However, this critical juncture is also the ecosystem's most dangerous chokepoint.

The bridge between the onchain and offchain worlds creates a fundamental decentralization paradox. The assets themselves are permissionless, global, and decentralized. Yet the gateways required to access and use them are, by legal necessity, centralized, regulated, and often fragmented bottlenecks. A collision of these architectural paradigms results in a massive, systemic "identity tax" levied upon every company operating as a gateway. To comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, each of these companies must build and maintain its own expensive, and inefficient identity verification infrastructure.

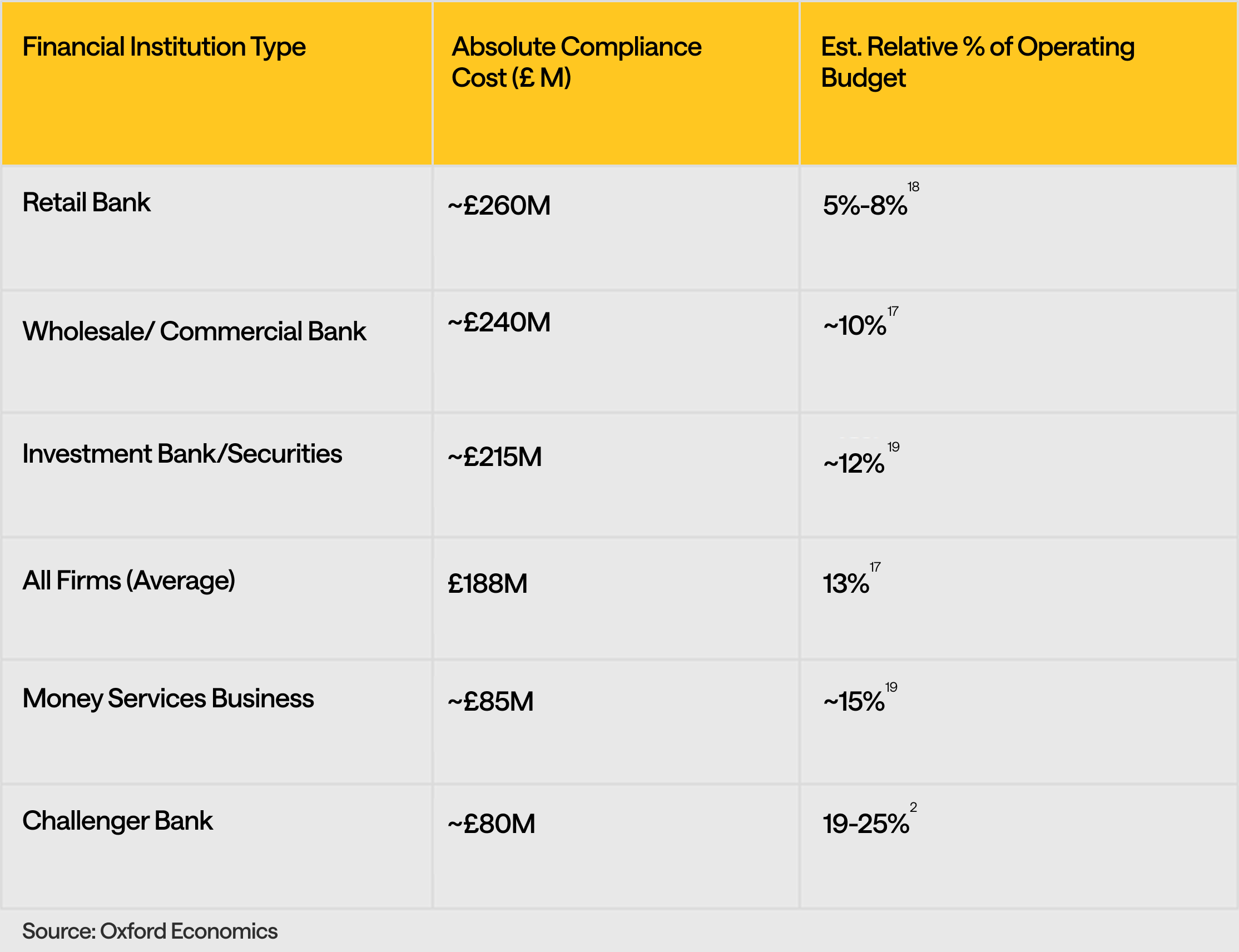

The global cost of this financial crime compliance is not trivial. A 2023 report from LexisNexis quantified the total annual burden on financial institutions at a staggering $206 billion. With the report’s noted annual growth rate of 12%, as of 2025 this cost might have risen closer to $280 billion. The figure represents the total size of the Identity Tax paid by the global financial system to maintain this fragmented and outdated architecture. This macroeconomic cost translates into a direct operational burden. For large financial institutions, compliance is not a software problem but a human capital problem, with reports indicating that 10-20% of total payroll is often dedicated to compliance staff alone. An immense and unsustainable drain on resources that could otherwise be directed toward innovation and growth.

It is not only that nominal spending of £188m on average per financial institution is high, it’s even worse that this ‘tax’ is levied the smaller the bank. This burden hits innovative fintechs especially hard as they do not have the scale to offset cost among different revenue streams. Crucially, our own survey of the stablecoin industry confirms that this identity tax has been fully inherited by the new crypto economy. Half of stablecoin-native firms report spending between 5% and 20% of their entire operational budget on compliance. The data proves that the industry is attempting to build a 21st-century financial system on the back of a 20th-century compliance architecture. This fundamental inefficiency is an urgent problem the ecosystem must now solve.

The User Onboarding Gauntlet

The compliance bottleneck is not merely an operational cost. The failure manifests as a disastrous user experience, creating a wide chasm between crypto-native early adopters and the mainstream market. This chasm is the user onboarding process, a high-friction gauntlet that actively bleeds customers and stifles growth. The failure to bridge the chasm to the mass market is located squarely at the user onboarding process. Historically, mainstream technology adoption has always been preceded by a moment of mainstream convenience — an experience so simple and intuitive that it removes all barriers to entry. The current onboarding process for most neobanks and stablecoin applications is the exact opposite of this.

It is a high-friction, high-anxiety ordeal that forces users to repeatedly surrender their most sensitive personal documents to dozens of new, unfamiliar applications. A process where every service demands a fresh start creates a powerful headwind against adoption, turning away all but the most determined users.

The friction is not merely a qualitative complaint. A 2021 Incognia’s analysis of the fintech landscape found that the average mobile onboarding process requires a user to navigate 14 screens, do 29 distinct clicks, and fill out 16 distinct fields. A convoluted journey, which takes an average of six minutes to complete, represents a significant barrier to entry for the average consumer. The consequences of this poor user experience are catastrophic for customer acquisition. A 2025 report from Fenergo, a leading provider of client lifecycle management solutions, delivered a stark finding: 70% of financial institutions worldwide lost clients in the past year specifically due to slow and inefficient onboarding processes. Even more alarming is the trend line. The 70% client loss rate is the highest figure recorded to date, up from 67% in 2024 and 48% in 2023. The problem is not only unsolved; it is actively getting worse. The industry's current approaches are failing.

A vicious cycle is thus revealed, defining the market's architectural failure. Firms are trapped paying hundreds of billions of Identity Tax to fund massive, manual compliance teams, which in turn create the very mechanism that causes a record-high 70% client loss rate. In essence, companies are spending billions of dollars to become worse at acquiring and retaining customers.

The current market is not consolidating from a few large banks to a few large neobanks; it is fragmenting into a complex graph. In this new topology, the average user will interact with a vast and growing number of financial applications, protocols, and increasingly, AI agents. In this fragmented landscape, a user's identity is the only persistent thread capable of connecting the disparate nodes of their financial life. Today, however, that thread is broken at every single point. Each new application demands a redundant KYC process, forcing the user to run the onboarding gauntlet again and again.

Meanwhile, zero-knowledge proof technology, while a powerful cryptographic tool, is not a complete solution. A ZK-proof is a feature, not a protocol. It can prove a specific fact in isolation, but it does not, by itself, create the interoperable network, governance rules, or economic models needed for a truly functional identity system. The market does not need another siloed application or another cryptographic feature. It requires a neutral, composable layer — an open protocol for identity. It needs a set of shared rules that anyone can build upon without asking for permission.

This new layer should allow users to bridge their identity as seamlessly and securely as they currently bridge their assets. The technical blueprint for such a system is the “passporting” model, where it allows a user to verify their identity once with a trusted entity and then reuse that verification across the entire ecosystem. The model then issues a cryptographic stamp in the form of a Verifiable Credential. The user can seamlessly move this credential to new Verifiers, such as neobanks or DeFi protocols, who can programmatically rely on the original verification without requiring the user to start from scratch.

Permissionless identity layer architecture is transformative because it realigns economic incentives. It turns identity compliance from a pure cost center into a potential revenue center for the Issuers. By charging a small fee for the reuse of the verified data, significantly lower than the current costs, the protocol could create a powerful incentive for trusted institutions to participate, effectively bootstrapping a network that solves the fragmentation holding the entire market back.

Survey Reveals Top Hurdles

To quantify the friction points related to identity within the stablecoin economy, we conducted an exploratory survey with a select group of founders and C-level executives representing the leading edge of stablecoin infrastructure. The respondent pool encompasses a range of business models — spanning B2B (18.2%), B2C (36.4%), and B2B2C (45.5%). Participating firms include industry pioneers such as Aave Labs, RedStone, Holyheld, Ready, Midas, and others. Their responses provide a firsthand look at the operational realities of firms managing billions in volume while navigating a complex regulatory landscape.

The thesis for a new, open identity protocol is not just a technical argument, but a direct and urgent response to the acute, measured pain points expressed by the industry. Our Survey reveals a market that is not just ready for this solution but is actively demanding it. When asked to identify their priorities and hurdles, the responses from industry leaders paint a clear and consistent picture. The data provides a mandate for a new identity layer that can solve the market's most pressing architectural problems.

Finding 1: The Core Problem is Friction

The industry’s biggest operational hurdles are not minor feature requests but fundamental architectural complaints. When asked to rate their top hurdles; the problems of fragmentation and friction dominate. "Siloed ecosystems and insufficient interoperability" was rated as a top hurdle by 64% of respondents. This fragmentation is felt directly by the end-user, with the same percentage of firms rating the "complexity and risks of self-custody management" a critical problem. Most importantly, the acute pain of the onboarding gauntlet is summed up by 73% of respondents marking “KYC orchestration problem”, specifically assuring that users don’t have to KYC twice, as a significant pain point, presenting a clear demand for a reusable, portable identity solution.

Finding 2: The Top Priority is Mitigating Risk

Given the fragmented system, the industry's top priorities are entirely defensive. When asked to rate the importance of identity system properties, the highest-rated concerns were not about speed or new features, but about avoiding catastrophic failure.

The number one fear, with 100% of respondents rating it a critical priority, is the "avoidance of data breach or hack." The current model forces every neobank and application to create its own centralized "honeypot" of sensitive user data. Firms are rightly terrified of the immense legal, financial, and reputational liability of a breach. This is followed by the two other top operational threats: 82% rated “fake identity onboarding by bots/AI” and 73% rated “avoidance of data privacy compliance & requests” as significant features of identity systems.

A decentralized, user-centric model — where the user holds their own verifiable credentials and shares proofs rather than raw data — architecturally solves this number one fear, eliminating the honeypots and dramatically reducing the attack surface for the entire ecosystem.

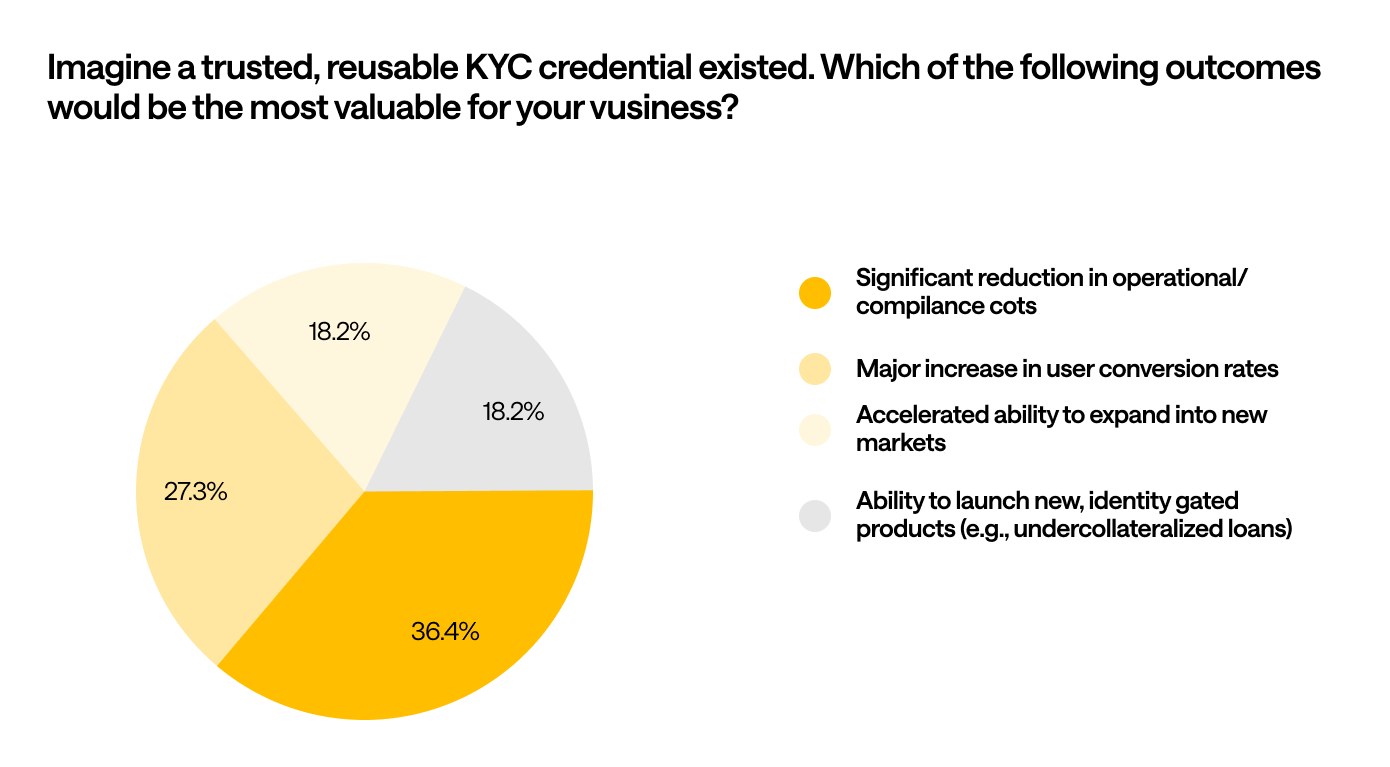

Finding 3: The Business Case is Cost Reduction & User Conversion

While the fears and needs are primarily around the user experience and security, the solution the market is asking for is one that directly impacts their bottom line. When asked which of the outcomes would be most valuable if a trusted, reusable KYC credential existed, the answers focused on cost savings and driving better conversion rates:

- 36.4% identified a "Significant reduction in operational/compliance costs." This is the direct antidote to the Identity Tax that currently devours a massive portion of operational budgets.

- 27.3% pointed at "Major increase in user conversion rates." This addresses the 70% client loss rate caused by the friction of the onboarding gauntlet.

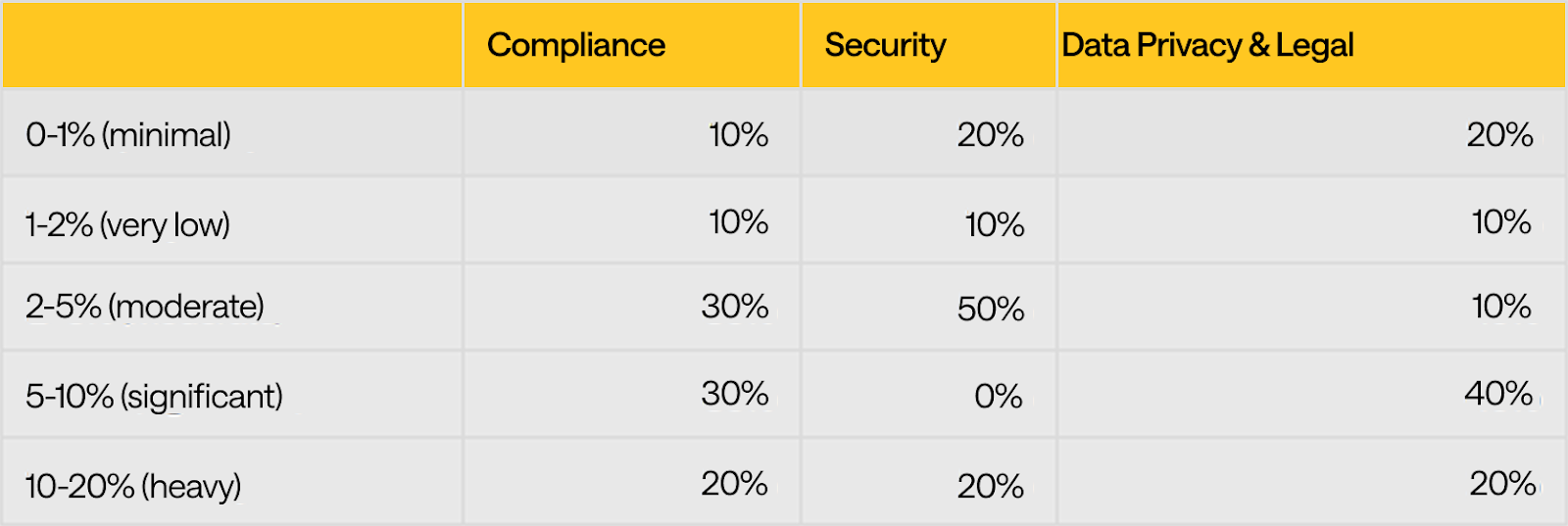

Moreover, listing current cost splits between compliance, security, and data privacy and legal cost, the data shows that security is the most consistently high-priority expense among the respondents. However, all three categories represent significant costs with a large portion of companies allocating 5% or more of their total operational budget to each category.

As a percentage of your company's total annual operational budget, what is your estimate for the portion allocated to:

Finding 4: The Market is calling for a 10x solution

The industry requests not for a marginal improvement but for a fundamental architectural leap. The primary hurdles are not just technical but commercial and regulatory, while the catalysts for adoption are likely needed to succeed. Respondents identified barriers that explain why this problem remains unsolved, hurdles primarily rooted in market structure, regulatory caution, and persistent friction.

- Regulatory and Commercial Inertia: The most significant blocker is a herd safety mentality. As one respondent noted, it is currently perceived as "safer to use a centralized KYC provider that everybody else is using" to avoid unique regulatory scrutiny. This inertia is compounded by the fact that some existing "KYC sharing flows now already work," meaning any new solution must offer a 10x advantage to compel a market-wide shift.

- Misaligned Economic Incentives: The core business logic of the current "bring your own compliance" model is a primary barrier. One respondent succinctly captured this commercial friction: "Why would APP A implement a flow to enable APP B to reuse its KYC? They won't." Without a neutral, protocol-level incentive structure that fairly compensates participants, data-sharing remains a zero-sum game, locking in the fragmented, siloed ecosystem.

- Technical Fragmentation: The "lack of interoperability between vendors" and the "lack of one solution" create a classic chicken-and-egg problem. This fragmentation forces any new solution to solve not just for its own users, but for the connections to the entire ecosystem, a challenge that demands ease of integration.

The most compelling wedge into the market is not just reusable KYC, but solving the entire authentication and security stack. A winning solution must "successfully abstract blockchain and crypto complexities," leveraging familiar elements like passkeys and biometrics to create seamless, self-custodial accounts. This broader focus can provide the 10x improvement needed to drive adoption.

Sizing the Opportunity – The Value of Trust

To visualize the opportunity, we must compare the valuations of current identity and connectivity giants. The market already values identity-focused networks on par with core payment and banking APIs, signaling that identity is a strategic cornerstone, not a cost-center.

- Okta (OKTA): The leader in workforce and customer identity (CIAM) boasts a market capitalization of approximately $16.76 billion as of January 2026. Okta's value is derived from its role as the gatekeeper of access, yet its centralized model creates "honeypots" that 100% of firms cite as their top security fear.

- Plaid: The "financial plumbing" layer was valued at $13.4 billion in 2021 and, despite a recalibration to $6.1 billion in 2025, remains a critical component of the fintech stack. Plaid’s model relies on legacy bank APIs, a hurdle that a decentralized protocol abstracts through user-controlled credentials.

- Alloy: Positioned as an identity decisioning platform for fintech, Alloy maintains a valuation of around $1.5 billion.

The existing verification system was built for a pre-2020 world of manual processes and national silos. It is defined by three critical mismatches with the reality of onchain finance: a speed mismatch (manual days vs. transaction seconds), a geographical mismatch (national silos vs. global assets), and a programmability mismatch (human back-offices vs. automated smart contracts). The opportunity is to capture and abstract the fragmented, multi-billion dollar markets for login, compliance, and trust, bundling them into a single, interoperable layer.

The most critical failure is the lack of programmability. Legacy identity is a manual process, run by compliance officers in a back office. Stablecoins are programmable assets, run by automated smart contracts on a blockchain. A smart contract cannot make a phone call to a compliance officer; it requires a machine-readable yes/no answer to a compliance query.

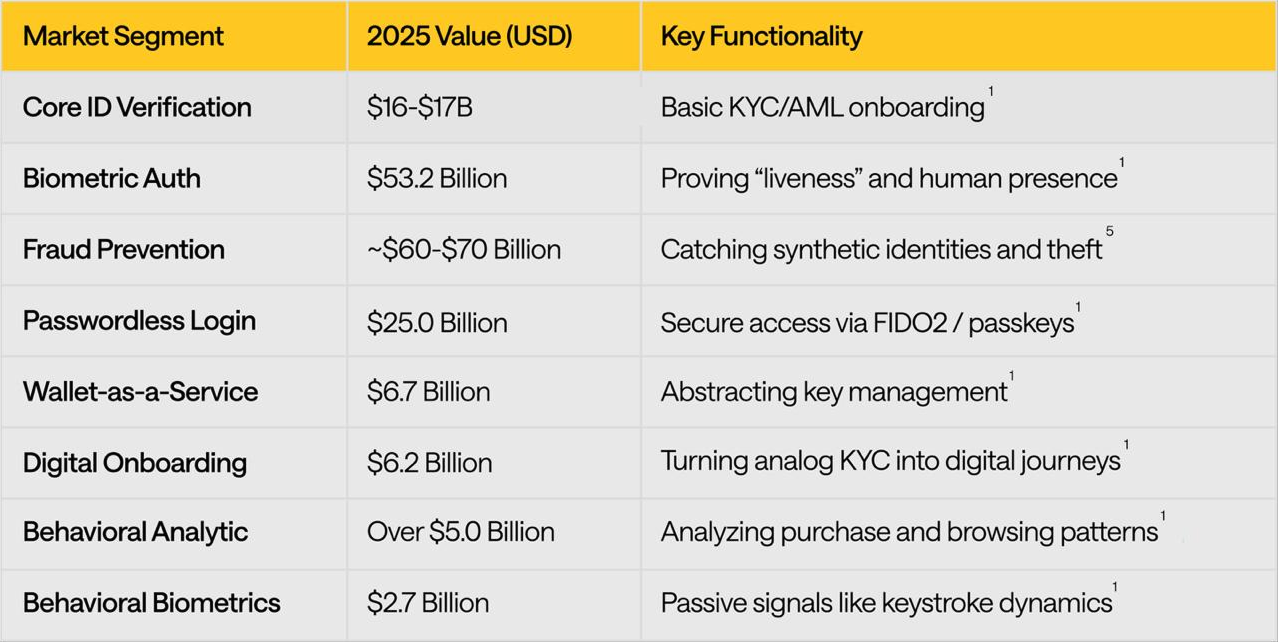

The budget for this new identity layer is vast. While the specific market for Identity Verification tools is projected to hit $14.8 billion in 2025, the broader Digital Identity economy is even larger. Juniper Research reports that total global revenue for digital identity services reached $51.5 billion in 2025 — a massive sum currently spent just to bridge the trust gaps in our outdated digital infrastructure.

The most immediate market expansion comes from a fundamental shift in the volume of identity events. The market is moving beyond the simple, one-time "KYC-able event" — the initial fiat on-ramp — as financial services turn from being monolithic to being modular In this new paradigm. The stablecoin interoperability is fracturing the monolithic user experience, just like the internet fractured the number of accounts per user. This means the market for such identity verification products will grow significantly faster than the user base itself, creating a compounding revenue model for providers.

A composable identity stack allows adding other third party services that are adjacent to identity. This aggregation of required services makes the addressable market go far beyond the initial KYC aspect. The idea of an identity platform is neither new nor unchartered, but blockchain technology can provide the neutrality guarantees needed to overcome objections like the fear of a locking effect and platform risks. This unlocks a larger opportunity, as allowing third party services and products to use a neutral platform as a distribution platform significantly reduces go-to-market times and resource requirements. We have seen this strategy before: To catch up with iOS dominance, Google decided to open source Android to pool development among all remaining mobile phone companies. An open source identity platform wouldn’t require one company to build it all, but offer the basis for dozens of specialised identity, encryption, biometric and other companies to offer their services on a neutral platform. This bundled offering is worth more as the sum of the individual parts, as the value proposition offsets the integration effort the more features the stack has. Just as each existing app makes a mobile phone more attractive to users.

Abstracting the Stack

The current user experience for accessing digital finance is a patchwork of insecure and high-friction technologies. An open identity protocol provides the infrastructure to abstract and unify these disparate, massive markets.

A universal protocol acts as the connective tissue for these markets, allowing a developer to plug into a single identity layer that handles liveness, passkeys, and wallet security simultaneously.

- The Biometric Market ($53.2B): The foundational market for biometric systems (fingerprint, face, and voice) is valued at $53.22 billion in 2025. This entire sector is being mobilized to solve the "liveness" problem — proving a user is a live human.

- The Passwordless Market ($25B): The enterprise demand for secure, user-friendly logins has created a $25 billion market for passwordless authentication, driven by technologies like FIDO-compliant passkeys.

- The WaaS Market ($6.7B): Within Web3, the Wallet-as-a-Service (WaaS) market, valued at $6.7 billion provides the B2B infrastructure that abstracts away the complexity of key management, a core component of the identity stack.

The global AML market provides the clearest quantitative case for a new architecture. This market is defined by a massive inefficiency, the Total Cost of Compliance (TCC) — what institutions spend internally on manual compliance staff, fraud investigation, and legacy systems — is a staggering $33.9 billion annually. The Addressable Software Market — what vendors sell in AML software — is only $3.4 billion.

The $30 billion gap represents the gross inefficiency of the current, siloed model. An open compliance layer attacks this gap. By leveraging shared data sources, such as the $10 billion Open-Source Intelligence (OSINT) market, a protocol can provide programmable, interoperable AML functions. This transforms compliance from a manual, internal cost center into an efficient, automated utility that any application can query.

The next frontier moves identity from a static, one-time check to a continuous, dynamic assessment.

- Behavioral Biometrics — a $2.72 billion market focused on how a user acts. It passively analyzes physiological patterns such as keystroke dynamics, mouse movements or swipe gestures, to provide continuous, session-based verification.

- Behavioral Analytics — a $5.15 billion market focused on what a user does. It analyzes cognitive patterns, like purchase history and browsing habits for both security and, critically, personalization.

In the onchain economy, these concepts evolve into a portable, user-owned reputation score. This Identity-based DeFi could allow a user's verifiable on-chain behavior (e.g., loan repayment history, governance participation) to serve as a persistent trust profile. Such onchain reputation is the technical prerequisite for the holy grail of decentralized finance: under- and un-collateralized lending.

The most significant, long-term expansion of the identity market is the creation of an entirely new compliance category. The rise of Agentic Commerce — defined by AI agents autonomously transacting on behalf of users — is projected by McKinsey & Co. to orchestrate $3 trillion to $5 trillion in global revenue by 2030. The new agentic economy creates a verification dilemma. The entire stack of today is built to verify humans (passports, faces, liveness). AI agents have none of these, fundamentally breaking the traditional KYC model and potentially obsoleting behavioral biometrics.

In response, a 0-to-1 market for Know Your Agent (KYA) is emerging. This is a new TAM for non-human identity verification. Just as every bank must buy a KYC solution to onboard a human, every platform that wishes to participate in the new agentic economy must buy a KYA solution. A programmable economy of smart contracts and AI agents requires a machine-readable, programmable identity layer to compliantly execute transactions at scale.

Unlocking the Future of Finance

Our analysis culminates in a clear investment thesis: the market's obsession with picking the winners in the stablecoin race is a high-risk gamble. The more robust, foundational bet is to invest in the picks and shovels protocol layer that all of these applications will inevitably need to build upon.

The "Webvan trap” of the dot-com bubble serves as a critical historical lesson. It is possible to be entirely correct about the transformative potential of a new technology, like the internet, and still lose everything by betting on the wrong application. Webvan, the infamous grocery delivery service, is the poster child for this strategic error. In this analogy, the "gold miners" are the high-risk, consumer-facing applications. This includes the neobanks, the competing L1 and L2 blockchains, and the specific use cases competing for dominance. A high-churn, red-ocean market where eventual winners are few. The "picks and shovels," however, represent the fundamental protocols underlying them that enable the entire ecosystem.

The identity layer is the ultimate picks and shovels play for three reasons: it is chain-agnostic, use-case-agnostic, and, most importantly, strategically neutral. It can operate on any blockchain and serve any application, from payments to lending.

Strategic neutrality is its most powerful advantage. Game theory dictates that competing applications, such as two rival neobanks, will never build their core infrastructure on a competitor's proprietary solution. Doing so would mean ceding their customer graph and platform control to a direct rival. Therefore, everyone has a powerful, mutual incentive to adopt a neutral, composable layer that no single entity controls.

The new identity layer is the technical prerequisite for an entirely new class of financial products that are simply impossible in today's siloed, over-collateralized, and plutocratic onchain ecosystem. It is the key that enables the true, long-awaited promise of crypto.

One of the most significant limitations of today's DeFi ecosystem is its reliance on over-collateralization. Because protocols have no way to assess the creditworthiness of pseudonymous borrowers, they must demand that users deposit more capital than they borrow. An open identity protocol can help solve this by enabling the creation of persistent, dynamic, onchain credit profiles, allowing protocols to offer undercollateralized loans based on reputation.

Furthermore, an open identity protocol finally solves the Sybil attack problem that has plagued decentralized governance. By providing a mechanism for Proof of Personhood, it allows DAOs to move beyond the plutocratic one token, one vote model to a truly democratic one person, one vote system, ensuring that one malicious actor cannot gain outsized influence by creating thousands of wallets.

The ultimate result is the creation of a global, permissionless credit network. A single, user-controlled identity becomes a trustworthy credential that unlocks the entire financial ecosystem. With one identity, a user can instantly onboard to a new service, vote as a unique individual in a DAO, and apply for a loan based on their reputation, realizing the original vision of an open and equitable Internet of Money.

Sources:

- Stablecoins Are Imperfect but Inevitable, PitchBook

- True Cost of Compliance Report 2023, LexisNexis

- Fintech Mobile Onboarding Friction, Incognia

- Financial Crime Industry Trends 2025, fenergo

- Identity Verification Market Size and Share Analysis, Coherent Market Insights

- Digital Identity Market: 2025-2030, Juniper Research

- Biometric Technology Market Size And Forecast, Verified Market Research

- Passwordless Authentication Market, Dimension Market Research

- Wallet-as-a-Service Market Research Report 2033, Growth Market Reports

- Anti-money Laundering Software Statistics 2025, Market.us Scopp

- Crypto Compliance: Your Guide to do KYC/AML in 2025, KYC-Chain

- Behavioral Biometrics Market Insights, Allied Market Research

- Behavior Analytics Market Valuation, Verified Market Research

- The agentic commerce opportunity: How AI agents are ushering in a new era for consumers and merchants, McKinsey

- The Future of Agentic Commerce: Scaling Trust With Know Your Agent (KYA), Trulioo

- Are You Ready for Agentic AI Shoppers as Customers?, Vouched

- Reducing the cost of compliance, TheCityUK

- St. Louis Fed / CSBS Compliance Study, CommunityBanking

- CSBS Releases 2025 Annual Survey of Community Bank, CommunityBanking

About Piotr Kabaciński

Piotr is a Head of Research at Stablewatch, focused on in-depth analysis and developing risk models for innovative stablecoin solutions. He holds a PhD in Ultrafast Spectroscopy from Politecnico di Milano, and has coauthored over 15 high-impact papers in leading scientific journals. He has worked in DeFi as an investor for venture capital firms Geometry and Synergis Capital, after which he has founded a gas derivatives startup, later merged with Luban.