Aave V4: The End of Fragmented Liquidity

Aave V4

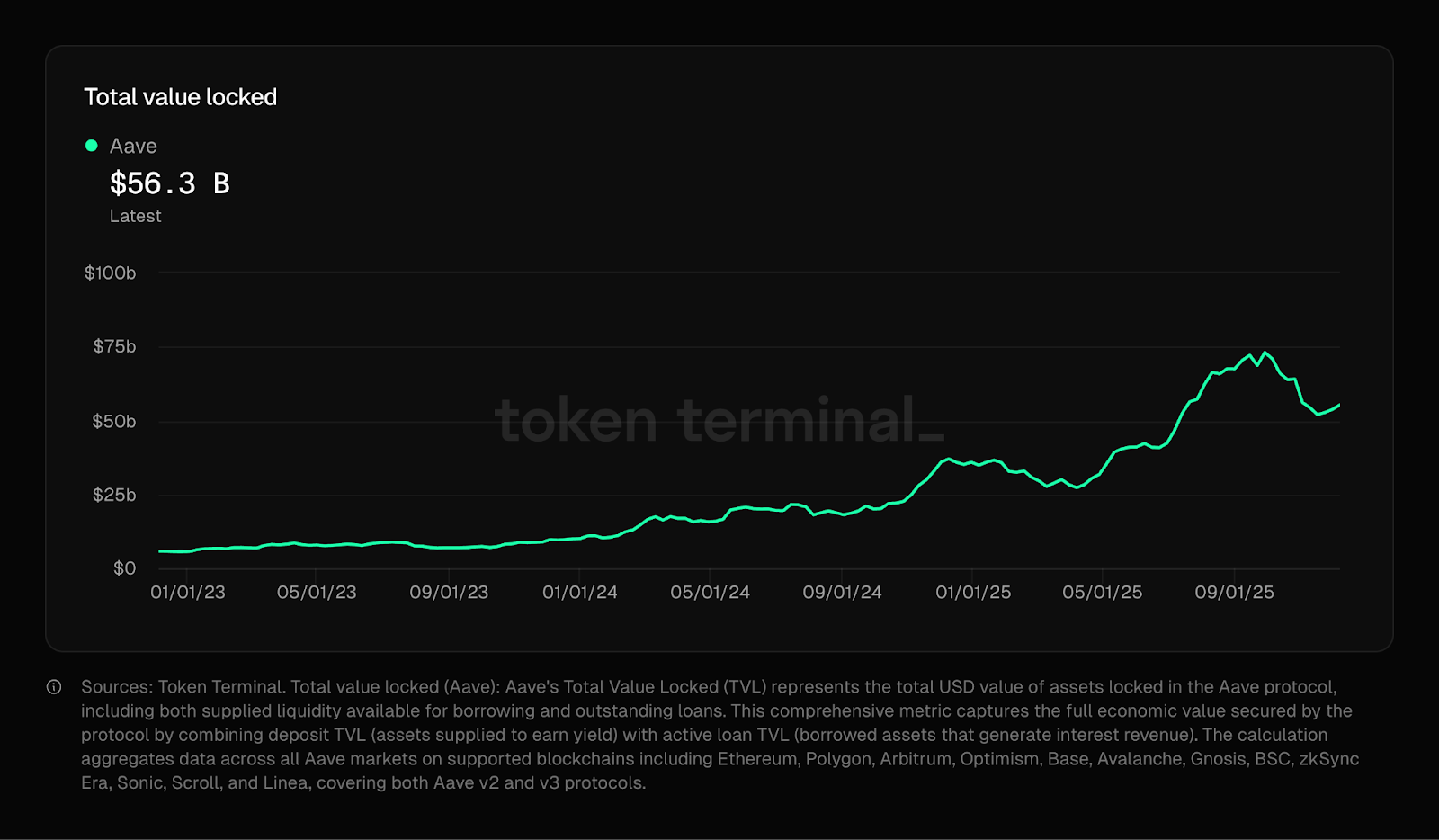

Since its inception in 2017 as ETHLend, Aave has been a pioneering force in DeFi, emerging as one of the first protocols to enable peer-to-peer lending on Ethereum. Over the years, it evolved into a dominant player in the DeFi lending landscape, boasting billions in total value locked (TVL) and setting standards for non-custodial borrowing and lending. Through iterations like V2 and V3, Aave introduced innovations such as flash loans, E-Mode, isolation mode, collateral swaps, and efficient risk management, cementing its role as a cornerstone of the ecosystem. Now, with the introduction of Aave V4, the protocol takes a bold step forward, embracing a more modular and scalable design. This evolution promises enhanced capital efficiency, better risk isolation, and the flexibility to support a wider array of financial products, all while maintaining the trust and liquidity that have defined Aave's success.

Aave V4 introduces a Hub and Spoke architecture that fundamentally restructures how liquidity is managed in the protocol, allowing for shared liquidity across diverse markets while preserving customised risk profiles. This innovative shift builds on the lessons from previous versions, enabling seamless liquidity flow without compromising on security or user control. In this article, we dive into how the new system operates, the key differences from V3, and the technical mechanics that empower different market configurations to share liquidity more effectively—ultimately unlocking new possibilities for lenders, borrowers, and builders in the DeFi space.

The V3 Architecture

Aave V3 operates through independent markets, each maintaining its own isolated liquidity pool. The Core market on Ethereum holds approximately $56 billion with a broad selection of assets. When users supply Stablecoins to Core, that liquidity underwrites the risk of all eligible collateral in that market. A supplier's stablecoins simultaneously backs borrowers using ETH, WBTC, LINK, and dozens of other approved assets, with no mechanism to isolate exposure to specific collateral types.

This structure creates tension between asset diversity and risk management. Adding a new collateral asset affects the risk profile for all suppliers in that market. Conservative suppliers seeking exposure only to BTC collateral must either accept indirect exposure to all listed assets or avoid the market entirely. Conversely, markets seeking to support novel or higher-risk collateral face the constraint that doing so increases risk for all participants. Currently the DAO acts as the risk curator for the Aave Core market and manages the limited pool of eligible collateral for borrowing. In addition to this supply, borrow caps and specific parameters add levels of protection for users however this as mentioned limits the modularity of the protocol.

How V4 Changes Liquidity Management

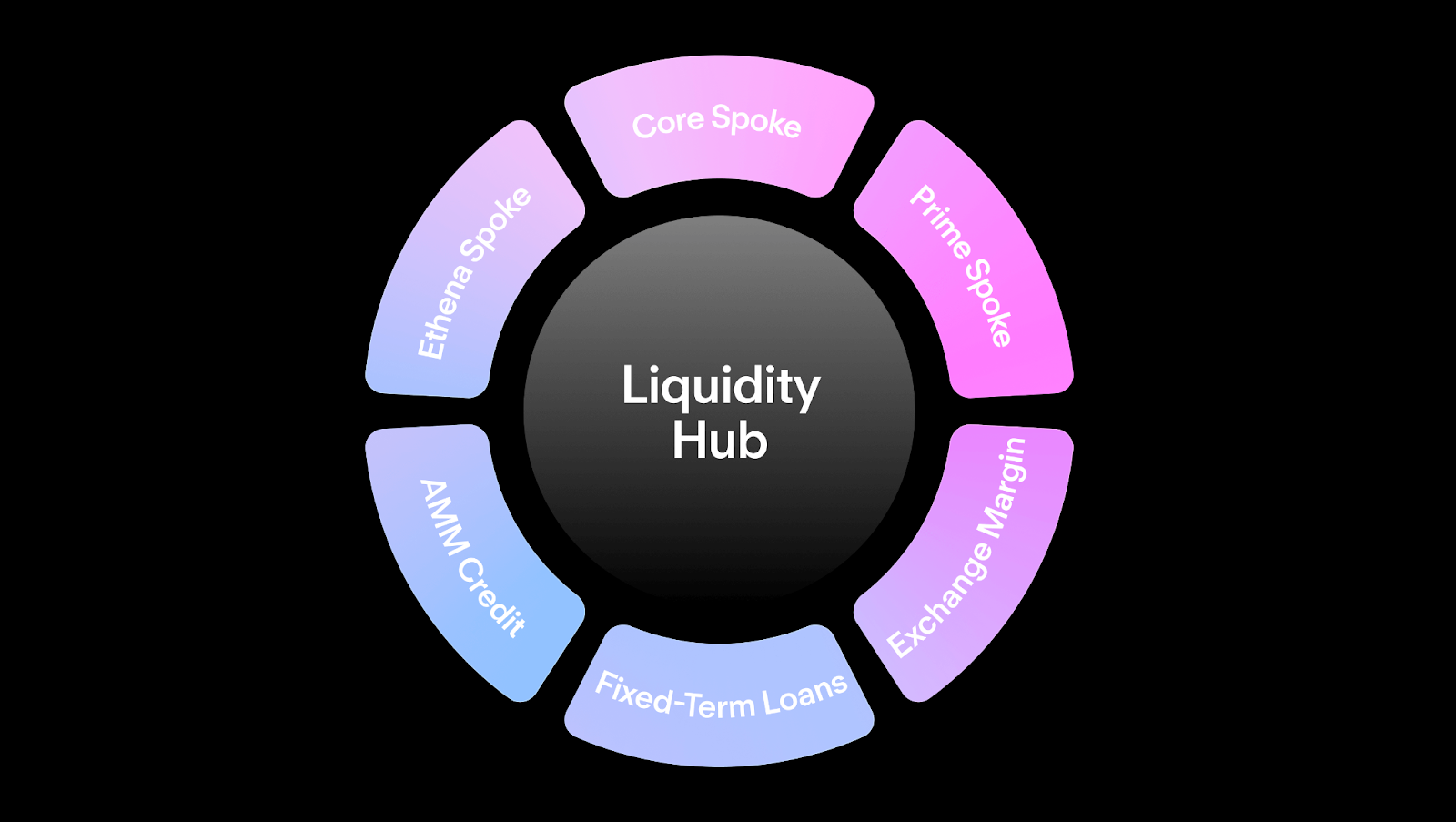

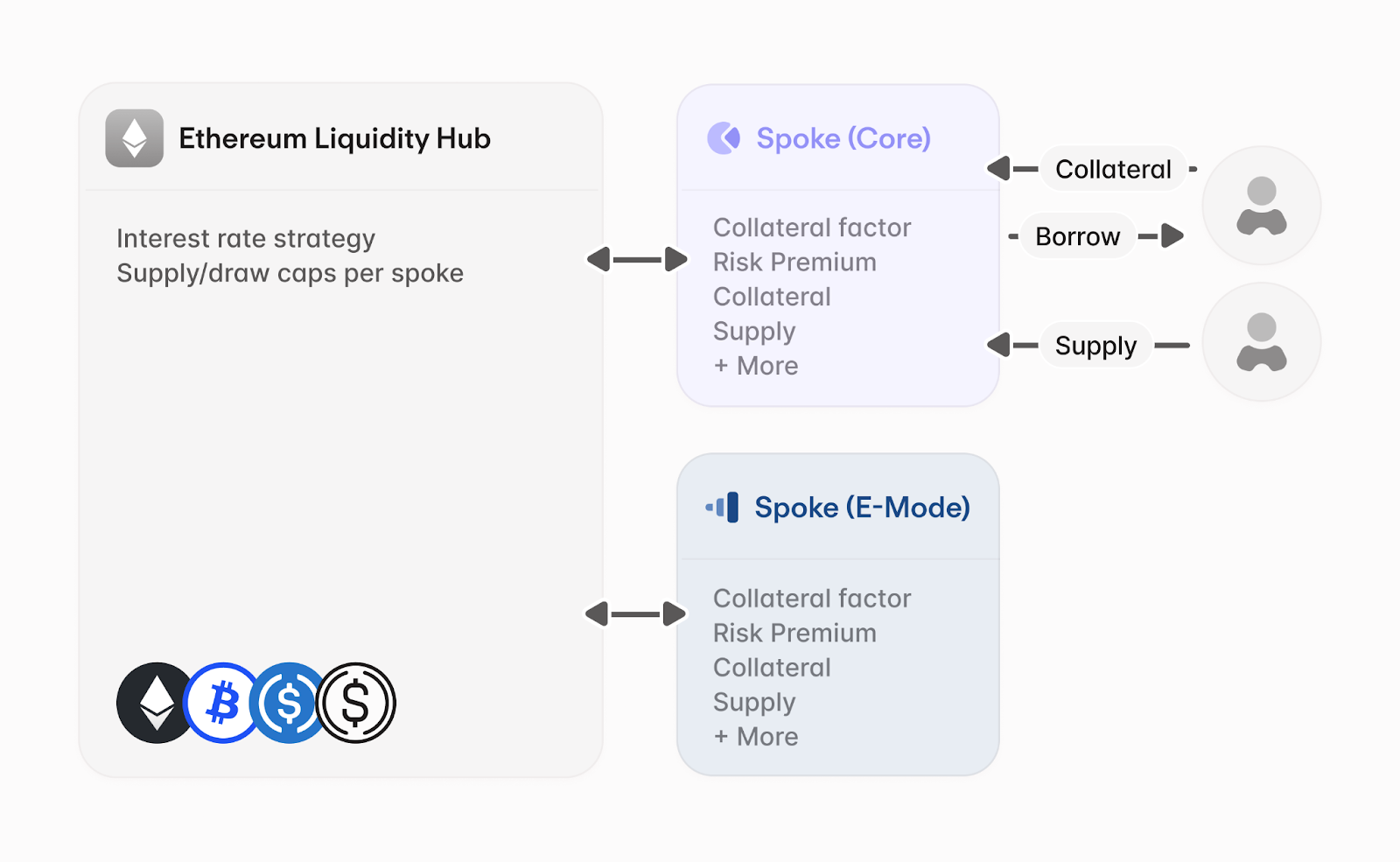

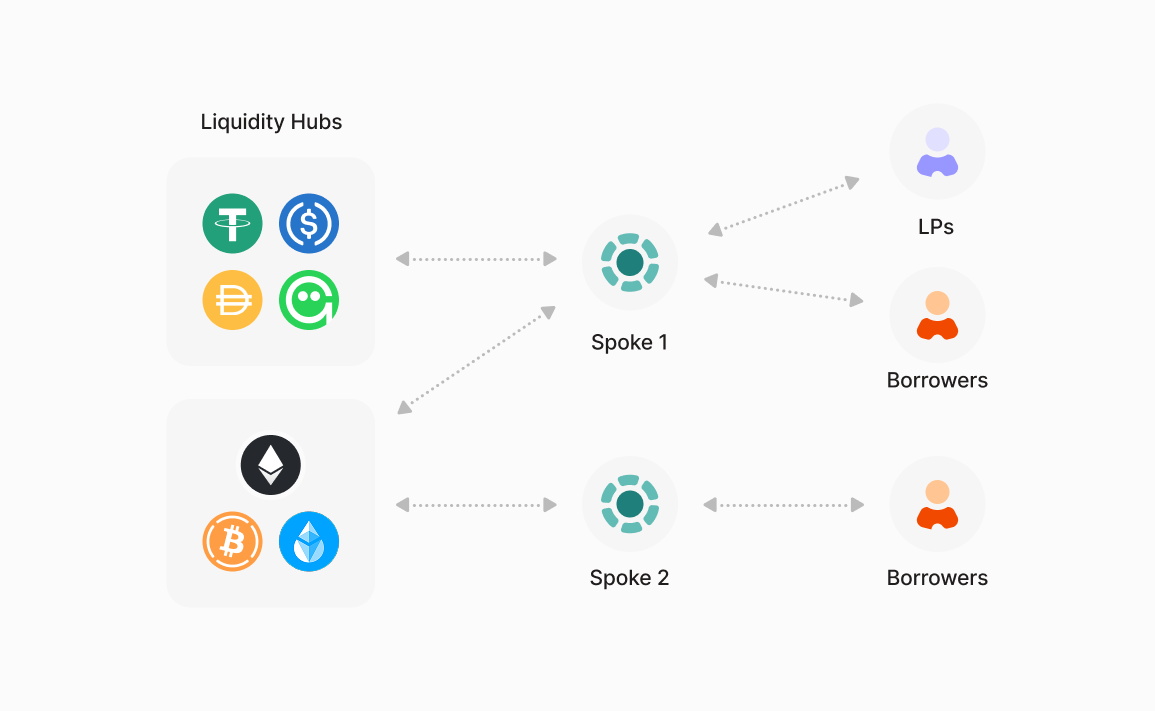

V4 addresses this by separating liquidity storage from collateral risk decisions. Liquidity Hubs hold borrowable assets like USDT in unified pools, while Spokes implement specific collateral rules and draw from these Hubs based on governance-defined credit lines.

When users supply USDT to V4, that liquidity flows into a Hub where it becomes available to multiple Spokes, each with distinct collateral profiles. A conservative Spoke might only accept ETH and WBTC, while a separate Spoke serves higher-risk assets. The same USDT can be borrowed across different Spokes, but each Spoke maintains its own collateral curation, creating risk compartmentalisation.

Each network has at least one Hub. Spokes connect to the Hub and access liquidity as needed. A Spoke accepting only blue-chip collateral and a Spoke serving experimental assets can both draw from the same Hub without forcing suppliers to choose between capital efficiency and risk exposure if they have a DAO approved credit line.

Liquidity Hub Mechanics

The Liquidity Hub tracks which Spokes can access which assets and enforces maximum limits on liquidity allocation. The Hub uses a share-based accounting system to track positions efficiently as interest accumulates.

The DAO defines credit lines that determine how much liquidity each Spoke can draw from the Hub. These allocations can then be adjusted based on Spoke performance, market conditions, and ongoing risk assessments. The Hub enforces these limits automatically, preventing any single Spoke from depleting liquidity needed by others.

The Hub does not implement lending logic or set market-specific parameters. Those functions occur at the Spoke level. The Hub's role is limited to liquidity storage, allocation enforcement, and system-wide accounting.

Spoke Functionality

Spokes handle all user interactions and implement market-specific rules. Each Spoke defines its own parameters for borrowing rates, collateral requirements, liquidation thresholds, and position management. When a user supplies assets through a Spoke, those assets move to the Hub but the Spoke tracks the user's position and manages their interactions with the protocol.

Spokes connect to oracles for price data, implement safety controls including emergency pause functionality, and handle the movement of assets between users and the Hub.

A Spoke can be configured for specific use cases. An E-Mode Spoke might allow higher leverage for borrowing assets against correlated collateral like different stablecoins. An Isolation Mode Spoke might have strict credit limits to contain exposure to newer tokens. An RWA Spoke might implement permissioned liquidations and transfer restrictions required for regulated assets.

Capital Efficiency Changes

Under V4, a single USDT pool in the Hub can serve multiple Spokes simultaneously. A user depositing USDT makes that liquidity available to all authorised Spokes within their credit limits, rather than locking it in a single market like in v3.

This affects utilisation rates. If Core has excess USDT sitting idle while a separate market faces high demand, V3 cannot rebalance that liquidity. V4 allows the shared Hub to allocate liquidity where demand exists, subject to governance-defined limits for each Spoke.

A specialised Spoke for Pendle Principal Tokens can access existing USDT liquidity from its first transaction, rather than requiring users to deposit USDT specifically for that market in the case of fully isolated markets. The Spoke still requires governance approval and credit line allocation, but does not face the same bootstrapping challenge.

Risk Isolation

Risk is managed at the Spoke level. If a Spoke experiences issues with bad debt or technical problems, those issues do not affect other Spokes or the Hub in a significant manner due to credit line system limits. Each Spoke operates with its own parameters and risk profile. Governance can add new Spokes or modify existing ones without disrupting other markets.

Collateral and debt are tracked per Spoke. A user's position in one Spoke is separate from their position in another. Liquidations occur within individual Spokes based on that Spoke's specific parameters. The Hub enforces overall system constraints but does not manage position-level risk.

Spoke Configuration Examples

E-Mode, which in V3 operated as a feature within markets, can become a dedicated Spoke in V4. A stablecoin E-Mode Spoke can set higher loan-to-value ratios for stablecoin collateral when borrowing another stablecoin, reflecting the low risk of borrowing assets against highly correlated collateral. In a similar manner a liquid staking token Spoke can implement parameters specific to stETH, rETH, and similar correlated assets.

Isolation Mode functionality translates to Spokes with governance-defined credit limits. These Spokes can list newer or riskier tokens while the Hub caps maximum exposure through credit line allocation. This allows the protocol to support experimental assets without creating system-wide risk.

Vault Spokes enable borrowing against assets held in external smart contracts. Users can borrow against positions in Safe or other custody solutions without transferring assets into the protocol. The Spoke manages risk and collateralisation while borrowed assets flow from the shared Hub.

RWA Spokes can implement the specific controls required for tokenised securities: transfer restrictions, custody requirements, and permissioned liquidation workflows. Each asset type can receive appropriate treatment through Spoke-level configuration rather than requiring separate infrastructure.

Risk Premium Mechanism

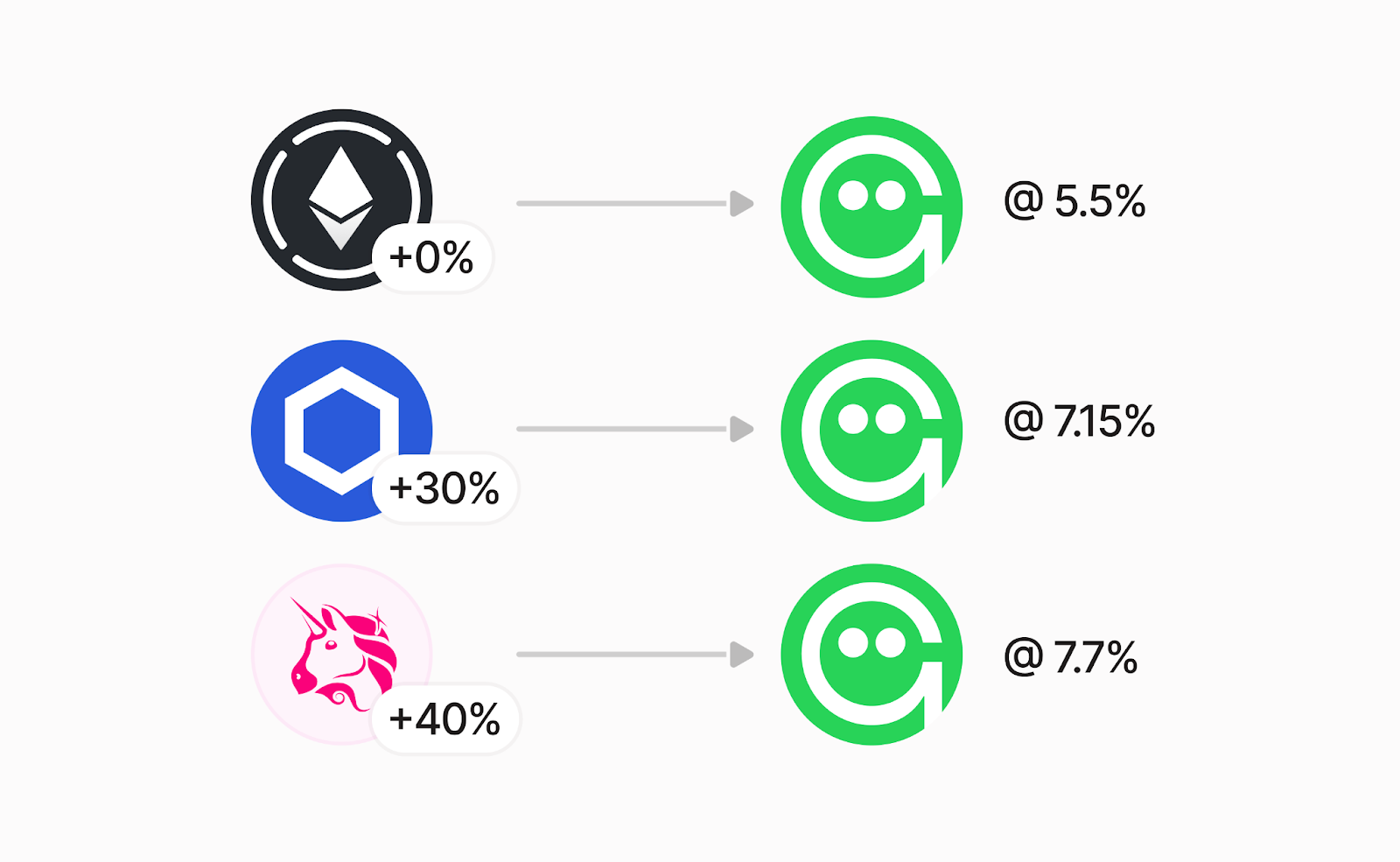

Aave V4 implements Risk Premiums to differentiate borrowing costs based on collateral quality. In V3, all borrowers in a market pay the same rate regardless of their collateral. In V4, borrowing costs vary based on the risk characteristics of each user's collateral portfolio.

The system operates in three tiers. Each asset receives an Asset Liquidity Premium, ETH might have a 0% premium while a newer token might have a 200% premium. Governance sets these values when listing assets.

User Risk Premiums represent the weighted average across an individual's collateral. If a user supplies $10,000 of ETH (0% premium) and $5,000 of a riskier token (200% premium), their User Risk Premium falls between these values based on dollar-weighted averaging. This calculation updates as positions change.

Spoke Risk Premiums reflect the aggregate risk across all users in a Spoke. Each Spoke calculates its average Risk Premium based on user activity. Different Spokes can have different risk profiles even when drawing from the same Hub.

The Hub sets base borrowing rates for each asset based on supply and demand using utilisation curves similar to V3. Users pay the base rate plus their Risk Premium. If the base rate for GHO is 5% and a user's Risk Premium is 30%, their total borrowing cost is the base rate plus an additional charge equal to 30% of their base debt accumulation.

Different Spokes can configure Risk Premiums differently. An EMode Spoke might apply lower premiums to proven liquid staking tokens and higher premiums to newer derivatives. An RWA Spoke might configure premiums based on the specific characteristics of tokenised securities.

Builder Access

The new architecture allows external developers to build Spokes. A developer can create a Spoke implementing specific lending logic, risk parameters, and market features. If governance approves the Spoke and grants it a credit line, it can access Hub liquidity.

Developers define their Spoke's parameters: which assets it accepts, what collateral ratios it uses, how it handles liquidations, and what specialised features it implements. The Spoke inherits access to Aave's liquidity, liquidation systems, and governance frameworks without requiring the builder to bootstrap deposits or rebuild core infrastructure.

This structure allows markets serving specific use cases to access established liquidity pools. A Spoke designed for fixed-term lending, secondary debt markets, or specialised collateral types can be built and connected to existing Hubs rather than operating as a standalone protocol requiring its own liquidity base.

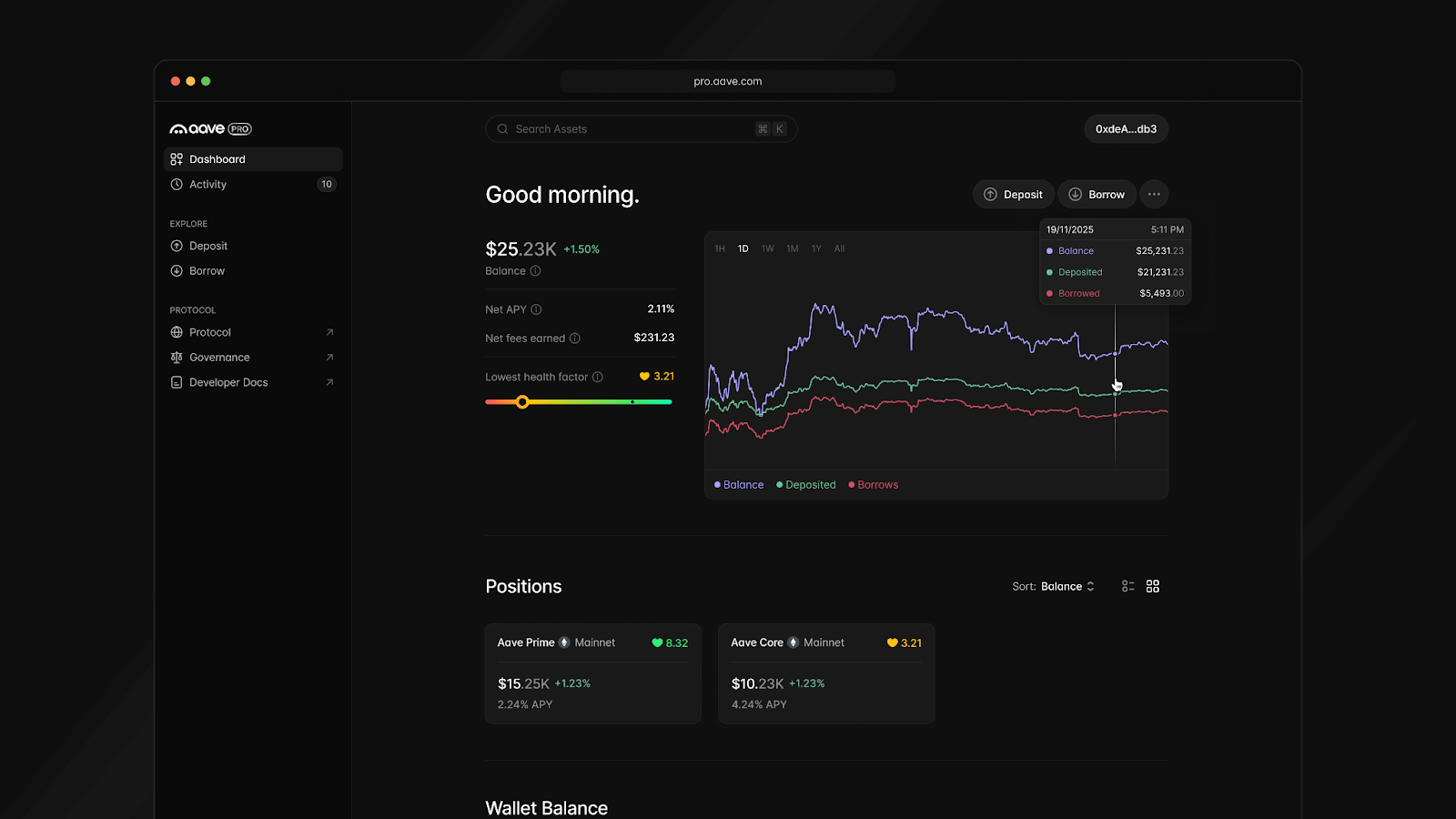

Testing and Development Status

Aave V4 testnet is live with the codebase available for public review. A developer preview of Aave Pro, an interface designed for V4, has been deployed. The testnet phase allows community testing and builder experimentation before mainnet deployment.

The codebase has undergone multiple independent security audits, with additional reviews planned before mainnet launch. Audit reports will be made publicly available closer to production deployment. Governance structures are being refined to support the new architecture's modularity.

What V4 Enables

The transition from isolated markets to shared liquidity infrastructure changes what types of lending markets can exist within Aave. Markets that previously couldn't justify the effort of bootstrapping their own liquidity pools can now be built as Spokes with immediate access to existing deposits. This applies to specialised use cases like lending against LP positions, fixed-term credit markets, or collateral types that serve smaller user bases.

For users supplying liquidity, their deposits can now serve multiple markets simultaneously rather than being locked in a single pool. This should improve utilisation rates and the yields suppliers receive. Borrowers gain access to specialised markets tailored to their specific collateral types, with borrowing costs that more accurately reflect the risk of what they're providing.

The modular structure means new lending products can be launched without requiring protocol-wide upgrades or migrations. As more Spokes connect to Hubs, the system should see improved capital efficiency across a wider range of use cases. Markets serving institutional users, RWA collateral, or experimental DeFi primitives can coexist while drawing from the same underlying liquidity, expanding the range of financial services available through the protocol without fragmenting its capital base.